Giving back to your community while reducing your tax burden is a win-win situation. By contributing to qualified charities, you can claim significant deductions on your federal income tax return. To maximize these benefits, it's crucial to understand the regulations surrounding charitable giving.

Firstly, ensure that the organization you choose is a registered 501(c)(3) entity. This designation confirms their eligibility to receive tax-deductible donations. Keep meticulous logs of all contributions, including the date, amount, and recipient. Secure a receipt or acknowledgment letter from the charity for each donation to support your claim.

When making your donation, consider strategies such as bundling gifts or performing a year-end contribution. Consulting a tax advisor can provide personalized guidance on maximizing your charitable deductions and ensuring compliance with applicable tax laws.

Remember, every donation, big or small, has the ability to make a difference while offering valuable tax advantages.

Decrease Your Tax Burden Through Giving Back

Giving back to those in need can be an incredibly rewarding experience. It's a chance to make a genuine impact on the world around you while also benefiting yourself legally. By making charitable donations to eligible organizations, you can reduce your tax burden and support causes that are important to you.

Tax laws often provide deductions for charitable giving, allowing you to decrease your taxable income.

This means that FAQs you can retain more of your hard-earned money while still making a impact.

To optimize your tax benefits, it's important to understand the specific rules and regulations surrounding charitable donations in your area.

Consulting with a financial advisor can also be helpful in ensuring that you are taking full advantage of all available options.

Giving back to those in need doesn't have to be a financial burden. By making strategic donations, you can minimize your tax liability while also making a difference.

Smart Giving

Maximize your philanthropic impact while minimizing your tax burden with smart giving strategies. By understanding the nuances of charitable giving laws, you can minimize your taxable income and make a real difference in the world. Explore various donation methods, such as property contributions and direct donations, to determine the most advantageous approach for your financial situation. Seek guidance from a tax advisor or financial planner to craft a personalized giving plan that supports your philanthropic goals and optimizes your tax efficiency.

Harnessing Financial Benefits: The Power of Charitable Donations

Charitable donations aren't just about helping; they can also offer significant financial advantages. By supporting qualified organizations, you can lower your tax burden. Numerous charitable organizations offer a range of initiatives that address critical social issues. When you contribute funds, you're not only making a difference but also benefitting financially.

provides a great opportunity to lower your tax bill while also.

Amplify Your Tax Benefits With Charitable Giving

Are you searching for ways to reduce your tax burden while making a significant impact on the world? Look no further than donating. By giving to eligible organizations, you can offset a portion of your contributions from your statement, effectively putting more money in your pocket. It's a win-win situation where your generosity translates into tangible financial savings.

- Explore the wide range of charitable organizations that align with your interests.

- Research the tax implications associated with different types of donations.

- Keep meticulous records to ensure a smooth and straightforward tax filing process.

Don't miss out on this incredible benefit to save money while making a difference. Start your journey towards tax efficiency today!

Maximizing Your Impact and Minimizing Your Tax Burden

Want to make a difference in the world while also reducing your tax liability? It's achievable! There are numerous methods available that allow you to give to causes you care about and simultaneously gain advantages financially. By understanding the tax implications of charitable giving, you can create a win-win situation for both yourself and the community.

- Explore various non-profits that align with your values.

- Consult a tax advisor to figure out the best giving strategies for your situation.

- Consider donating appreciated assets, such as stocks or real estate, to maximize your tax savings.

Remember, even small contributions can make a significant impact.

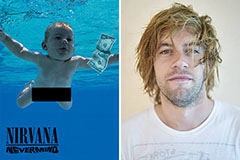

Spencer Elden Then & Now!

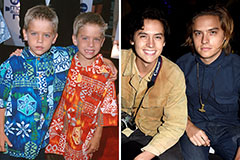

Spencer Elden Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!